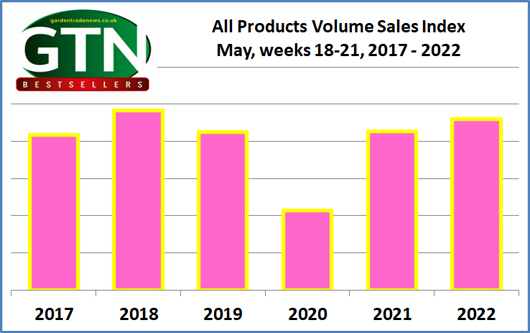

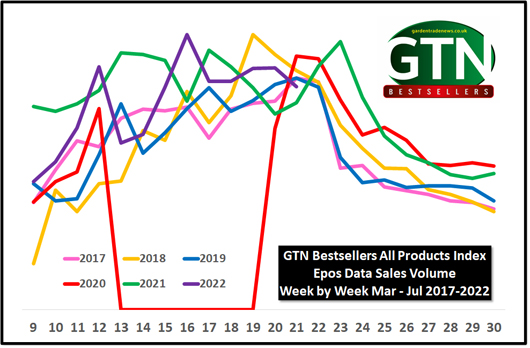

Total garden centre sales volumes (not value) for May in the GTN Bestsellers EPOS data ended up 7.7% on 2021 and up 8.2% on 2019. Only May 2018 has been higher for total sales volumes for the month and that was the busy may we had after a very poor Spring weather wise.

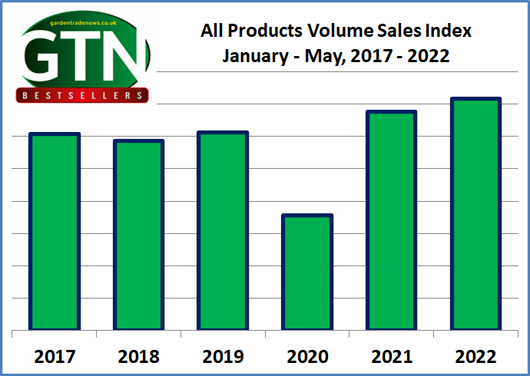

Year to date the GTN Bestsellers All Barcode products index now sits at up 6.1% on 2021 at the highest volume level in the GTN Bestsellers data archive.

The last week of May wasn't so good however, down 7.8% on the previous week and dipping below all but 2021 levels for the same week over the past 5 years.

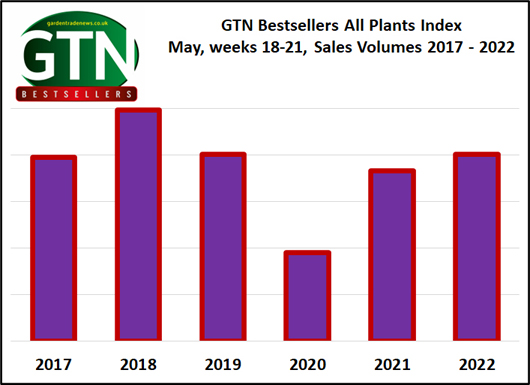

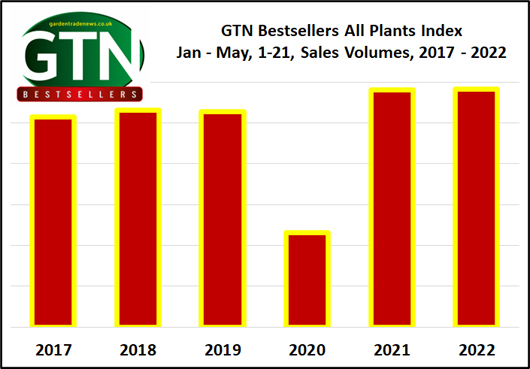

Total plant sales in May 2022 closed up 9.9% on 2021 and were level with May 2019 plant sales volumes.

Year to date plan sales show the maintained growth since the start of the pandemic. So far this year plant sales are 0.4% up on 2021 volumes and 10.6% higher than 2019.

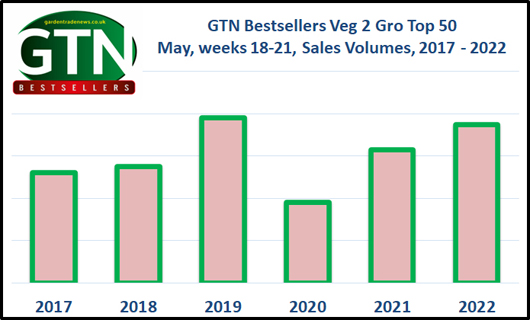

Veg 2 Gro sales were among the big winners in May 2022, the GTN Top 50 Veg 2 Gro lines (all veg plants in May) was up by 19% on May 2021.

That meant, after a fantastic five months for Veg 2 Gro sales, we are at record volumes year to date. Up 11.3% on 2021 and 21.6% ahead of 2019.

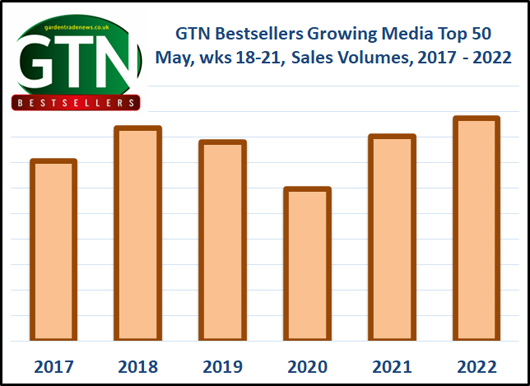

All those plants sales are fuelling the continued growth of growing media sales volumes. May 2022 saw GTN Bestsellers Top 50 Growing media lines volumes grow by a further 9%...

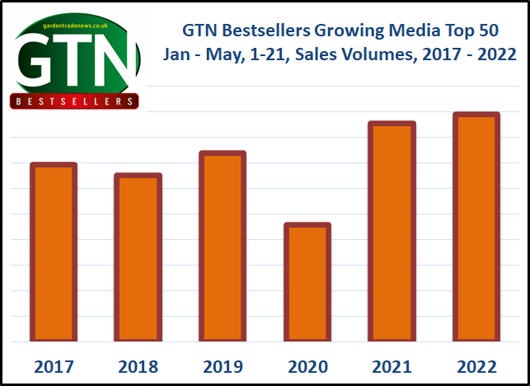

.. and that means we are at record growing media volumes for the first five months of the year, up 4.0% on 2021 and 20.6% on 2019.

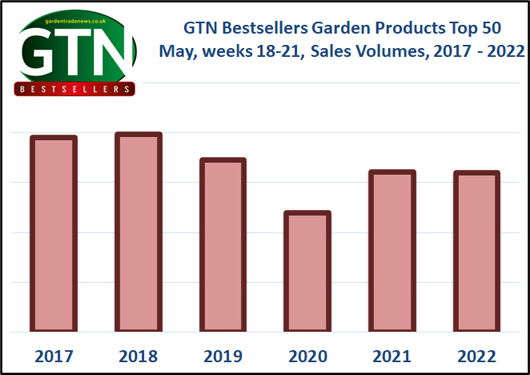

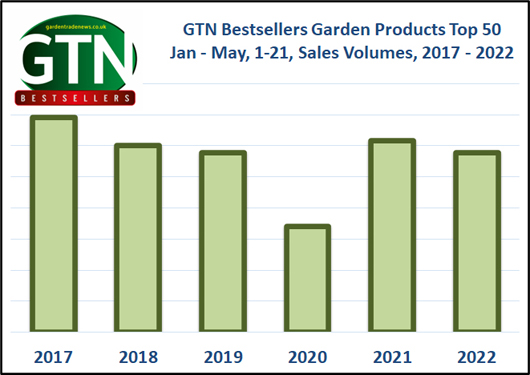

The GTN Bestsellers Garden Products Top 50 has not fared so well with a distinct lack of garden decoration lines being purchased this year. Top 50 volumes for May 2022 were static with May 2021, but down 7.3% on 2019 sales.

Year to date garden product sales have dropped by 6.3% compared with 2021 and by 16.3% compared with 2017 year to date.

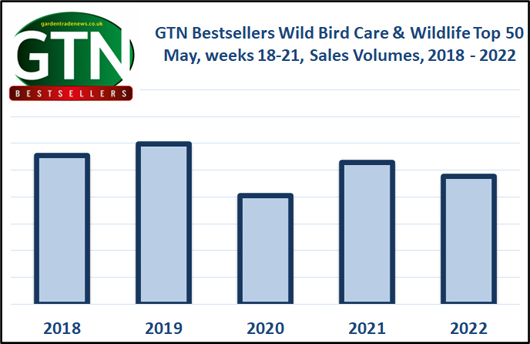

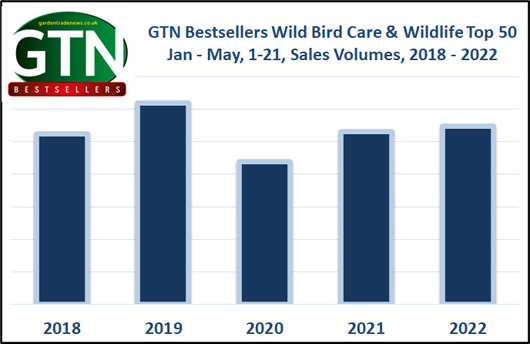

May 2022 was not a good month for Wild Bird Care sales, even though the weather was far from great. The months Top 50 sales were down 9.9% on 2021 levels and 20% down on re-pandemic sales in May 2019.

The year to date picture for Wild Bird Care shows an upward trend over the past three years, however the sector is currently 11.5% down compared with the year to the end of May in 2019.

Buy your subscription to the weekly GTN Bestsellers newsletter with the full GTN Top 50 charts using this link