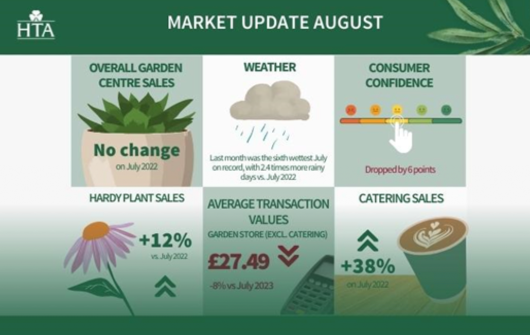

The Horticultural Trades Association (HTA) has just released its August Market Update report showing a prevailing narrative for 2023 that despite erratic weather patterns and economic fluctuation, the garden retail sector continues to demonstrate unwavering strength to perform well with a variety of consumer offerings.

Fran Barnes, Chief Executive of the HTA, commented:

"Sales in July have shown resilience amidst the unpredictable weather and economic changes of 2023. Overall, garden centre sales held steady, maintaining parity with the same period in 2022. A strong footfall of customers resulted in a notable uptick in transactions, up by +10% compared to July 2022 and +5% versus July 2021. However, it's worth noting that the contents of baskets reflected lower-value items, leading to an average transaction value decline of -8%. The decline in demand for garden furniture, from 15% of total sales in July 2022 to 10% this July, wasn't unexpected. This shift can be attributed to adverse weather impacts on outdoor leisure sales and the increased discounting strategies aimed at clearing excess stock. But we can also see that the palpable financial strain experienced by consumers is evident. The escalating cost-of-living crisis continues to prompt individuals to tighten their belts and actively seek savings amidst escalating expenses. July's Consumer Confidence Index published by GfK witnessed a significant dip of -6 points to settle at -30.

"Responding to these challenges, garden centres are maximising their consumer offerings, which has played a pivotal role in our members’ success this month. Non-garden/gardening categories surged by +18% year-on-year, fuelled by the vibrant activity of cafes and restaurants. This is reflected in the average transaction values, with catering sales soaring by +9% to £10.76. Additionally, the pet category demonstrated strong performance, surging by +21% as customers added toys and treats to their baskets. Meanwhile, the food & farm shop category grew by +13%, and wild bird care experienced a +10% increase compared to last July. I am also encouraged by the robust performance of plant sales, even in the face of a -9% dip in garden/gardening sales compared to July 2022. I’m certain that this variety within garden centres, as well as the belated gardening season, has contributed to maintaining a +1% year-to-date sales footing from June."

The monthly Market Updates also report on inflation rates. Over the 12 months leading up to July 2023, notable inflation rates were observed in the prices garden centre customers paid for weedkillers, plastic pots, and BBQs & heating, driven by escalating input and ingredient costs. Growing media experienced a 6% price hike, responding to heightened manufacturing expenses and the potential 2024 retail peat ban.

The HTA Market Updates are an indispensable tool for members, offering insights into their positioning amidst the membership and identifying areas of resilience, challenges, and opportunities.

The full report is available to HTA members on the association's website.