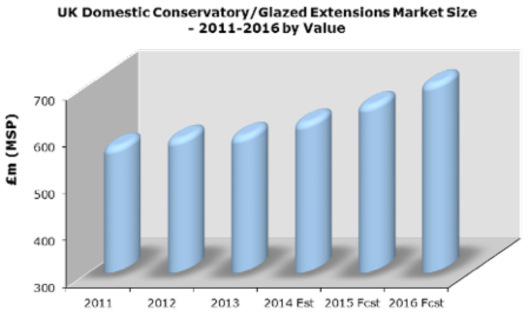

Following several years of decline, the conservatory market started to recover in 2012/13 and was estimated to be worth around £620m at the end of 2014.

A combination of a recovery in the economy in general - and the housing market in particular - have helped underpin rising consumer confidence and spending on higher value home improvements – particularly with interest rates so low.

Over the last few years, the market has become more sophisticated in terms of product range and offers more options for a bespoke project – options now include conservatories, glazed extensions which might have a solid or a glass roof, orangeries, verandas, loggias etc. Key product features which have become more important in the conservatory market include improved thermal efficiency, high specification self-cleaning glass, coloured frames, bifold opening doors etc.

In terms of frame materials, PVC-U continues to dominate, but timber has a reasonable share and has retained its attraction for many homeowners due to its natural appearance and sustainability credentials. Aluminium remains a more expensive option and while it has retained a niche share in the domestic market, aluminium bifold doors have gained widespread consumer acceptance.

Key suppliers are a mix of national retail brands, local suppliers and specialist conservatory installers. However, in broad terms, the supply structure for conservatories remains very complex and fragmented, reflecting the structure of the replacement window market. The conservatory roof systems sector is dominated by two leading players, both of which have expanded in recent years through acquisition. Consolidation is likely to remain a feature of the conservatory market, though a trend to more bespoke installations provides opportunities for local companies.

Main channels of distributions are replacement window companies, garden centres, DIY outlets, conservatory specialists, builders and online. In the ‘self-build’ conservatory sector, the distribution focus has switched from DIY outlets to online conservatory specialists, who offer a wider range of product options than those offered by DIY outlets.

Market improvement in 2015 and beyond is likely to be driven by an improving house moving market, growing consumer confidence and growth in the retrofit/upgrade market – particularly if interest rates remain at historically low levels. However, substantial increases in volumes or value are not expected in the short–medium term.

Market growth will only be possible if the UK economy sees sustained growth, alongside improvements in the house moving market, disposable incomes, and consumer confidence.

“In the longer term, our forecasts indicate steady growth, but we do not expect to see a return to the peak volumes achieved in the early-mid 2000s” said Andrew Hartley, Director of AMA Research. “However, work on existing conservatories will become a more important part of the conservatory/glazed installation market in the UK in the coming years, as more homeowners either replace or upgrade older models.”

The market for conservatories and glazed extensions in the UK is forecast to see relatively buoyant rates of growth in the medium term, and is expected to reach a value of over £760m in 2018 - though this is dependent on continuing recovery in the housing market and consumer confidence remaining buoyant.

The ‘Domestic Conservatory and Glazed Extensions Market Report – UK 2014-2018 Analysis’ report is published by AMA Research, a leading provider of market research and consultancy services within the construction and home improvement markets. The report is available now and can be ordered online at www.amaresearch.co.uk or by calling 01242 235724.